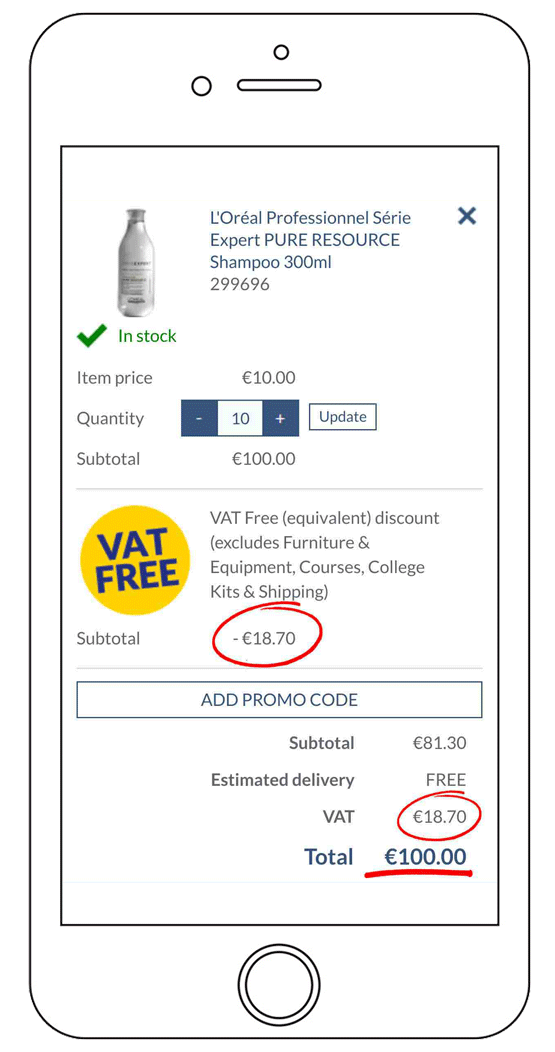

Salon Furniture & Equipment, Olaplex, K18, College Kits and Shipping are excluded from the offer

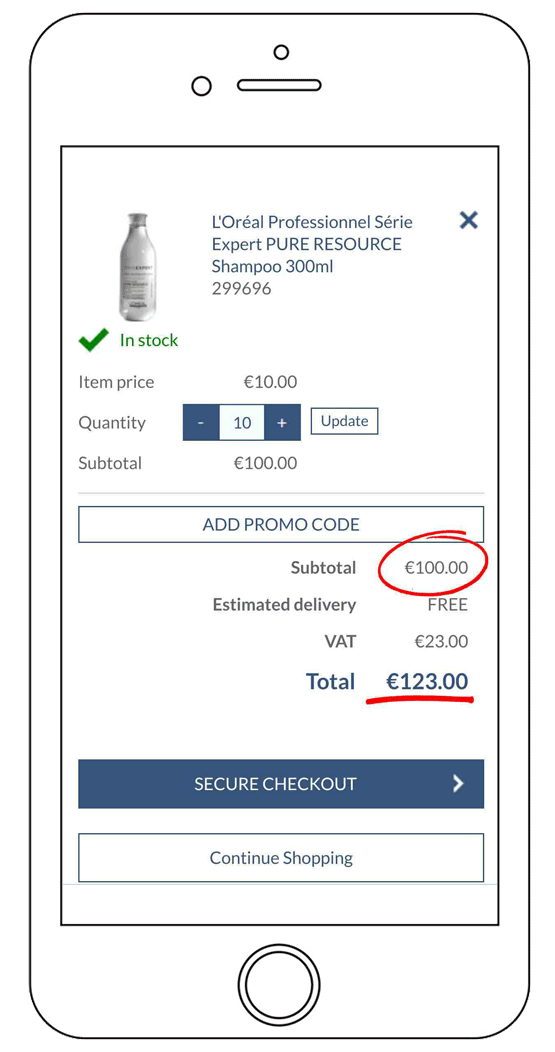

Online VAT Free: Minimum spend of €20 +VAT applies. Please ensure you have entered any promotional codes before checking out, as discounts cannot be applied retrospectively to an order. Open to personal callers only & does not apply to Click & Collect orders. This offer cannot be used in conjunction with 4+1 promotions, Salon Furniture & Equipment, Olaplex, K18 or College Kits.

In Store VAT Free Open Days: Subject to a €40+VAT minimum spend. This VAT Free offer means the total payable is the pre-VAT total of the merchandise. VAT Free promotion is available in selected participating Capital stores only and does not apply to online orders, click & collect orders or telephone orders. This offer cannot be used in conjunction with 4+1 promotions, Salon Furniture & Equipment, Olaplex, K18 or College Kits. Privilege Points cannot be collected or redeemed on any VAT Free day or event. Please refer to marketing communications for details.

If you’re VAT registered you can still reclaim your VAT!

Full terms and conditions here.